Alphabet’s $4 Trillion Chase: AI, Cloud, Chips and a Market Reborn

A 70% rally in 2025 has transformed Alphabet from a company defending its relevance to a frontrunner in AI and enterprise infrastructure, even as regulators, investors, and rivals question whether the momentum can hold.

Alphabet’s stock closed the week at a valuation just shy of $3.82 trillion, placing the company on the cusp of a milestone that only a handful of tech giants have ever reached.

The company’s performance in 2025 has seen a staggering 70% rally that has outpaced Microsoft, Amazon and even the AI-hype favourite Nvidia.

For a company that only two years ago faced investor doubts about falling behind in generative AI, Alphabet’s resurgence shows a reassertion of dominance.

The speed of this ascent has reframed the conversation around Alphabet’s identity as a company remaking itself through cloud infrastructure and in-house semiconductor innovation.

The Gemini 3 Pivot and Alphabet’s Reinvention in AI

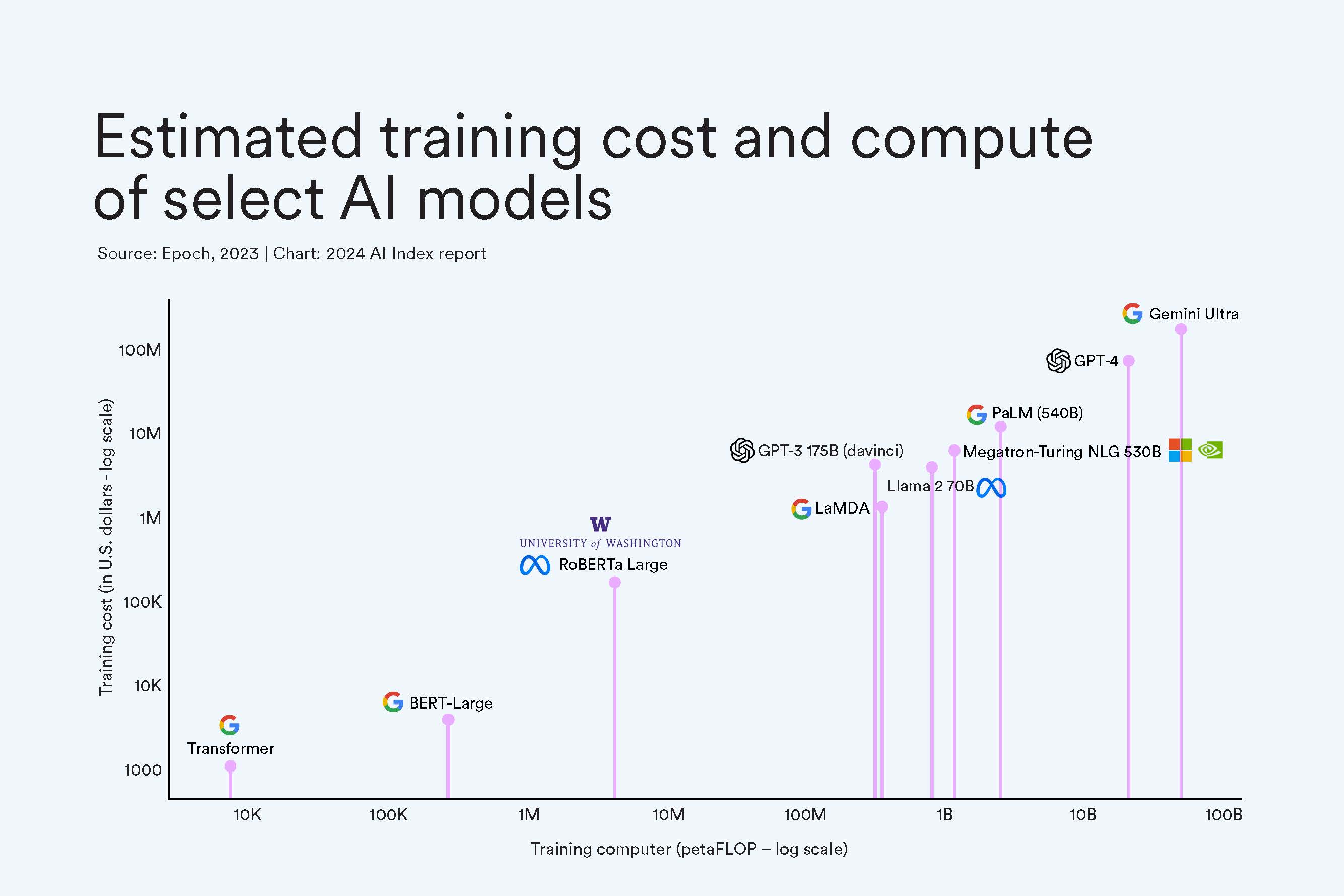

Few moments have shifted Alphabet’s fortunes as decisively as the launch of Gemini 3, a generative-AI system positioned as its most comprehensive challenge to OpenAI’s models.

The leap in capability gave investors renewed confidence that Alphabet had not forfeited the frontier of AI, rather, it had been quietly preparing to reclaim it.

Gemini’s integration across Google Workspace, YouTube, Search and Cloud strengthened Alphabet’s moat. For years, Alphabet had been criticised for possessing enormous research talent without translating it into market leadership.

But Gemini 3, paired with high-scale adoption from enterprise clients, reframed the narrative, and suddenly, the company’s deep infrastructure, data centres, AI chips, and cloud reach started functioning as a unified engine rather than disjointed assets.

Cloud Momentum and the Quiet Transformation of Alphabet’s Enterprise Business

The resurgence of Google Cloud may be the most consequential yet understated component of Alphabet’s valuation surge.

Once an afterthought behind AWS and Azure, Cloud is now seen as one of Alphabet’s strongest growth units, boasting significant wins in AI-native enterprises and government-grade workloads.

Alphabet’s push into AI-optimised data centres and its development of custom silicon, particularly its TPU architecture, has convinced analysts that Alphabet is no longer reliant on Nvidia’s bottlenecked GPU supply.

The company’s internal chip roadmap demonstrates a strategic focus on vertical integration, a trend replicated by rivals but arguably more comprehensive in Alphabet’s case due to its decades-long AI research foundation.

Cloud’s shift from a money-burning side project to a disciplined, strategic revenue driver now positions it as a core pillar of Alphabet’s long-term valuation story.

Wall Street’s Confidence Boost and Berkshire Hathaway’s Stamp of Approval

One of the more symbolic but powerful catalysts behind Alphabet’s ascent came from Berkshire Hathaway, whose investment in the company sent a clear signal that Alphabet’s fundamentals align with long-term institutional priorities.

Steve Sosnick of Interactive Brokers remarked that Berkshire’s presence often acts as a quiet market stabiliser since its positions are associated with patience and durability.

This endorsement, combined with Alphabet’s strong balance sheet and resilient ad business, reassured investors that the valuation was not being driven by narrative alone but by measurable, cash-backed performance.

Alphabet’s Biggest Unpriced Risk

Yet even as the stock races upward, the company faces the heaviest regulatory scrutiny in its history. Alphabet’s recent antitrust loss in federal court, where its search business was ruled an illegal monopoly, highlights the long-term legal overhang.

Although the court stopped short of ordering the breakup of Chrome or Search, the ruling sharpened scrutiny of Alphabet’s dominance across digital advertising and browser ecosystems.

The regulatory theatre extends beyond the US, as in Europe, India and Australia, efforts have intensified oversight around data usage, ad transparency and search neutrality.

Is the Valuation Rational or a New AI Bubble?

Alphabet’s climb raises an uncomfortable but unavoidable question of whether the company has genuinely entered a new era of profit-driven growth, or has AI speculation inflated valuations past sustainable limits?

A recent academic paper from early 2025 described the capability-realisation gap, arguing that AI valuations often price in long-term economic transformation before technical or commercial evidence supports them.

Investors today find themselves navigating this uncertainty, weighing Alphabet’s visible progress against the long-shadowed history of tech exuberance.

Yet compared to many AI-first companies, Alphabet possesses the rare advantage of diversification, regarding search advertising, YouTube monetisation, enterprise cloud, devices, and now a credible AI chip program.

This breadth provides a cushion, and perhaps a justification, that many AI high-flyers lack.

The Race to the $4 Trillion Club and What It Signifies

Alphabet now stands within striking distance of joining the world’s most exclusive valuation club.

Crossing the $4 trillion threshold would cement its status not just as an AI leader, but as a global technology anchor whose influence spans infrastructure, software, cloud and consumer services.

The milestone would also show the latest chapter in Big Tech’s power realignment, where companies are judged by their ability to control the underlying infrastructure that powers the next generation of AI.

What remains to be seen is whether Alphabet can maintain the momentum it has rediscovered by sustaining cloud growth, avoiding regulatory landmines, scaling its custom silicon programs, and defending search against what remains the most serious competitive threat in its history.

Alphabet’s charge toward $4 trillion is both a victory lap and a stress test. The company has regained its stride and built a compelling case for leadership in the AI era.

Yet the coming years will challenge Alphabet to deliver returns that justify this valuation and execute with precision at a scale where even small missteps can provoke seismic market reactions.

The world’s attention is fixed on Alphabet’s next move, because of what it represents, i.e. the shifting centre of gravity in global technology.