Nvidia Blows Past Expectations To Show That AI Boom Is on Shaky Ground

Stunning Q3 results quiet some concerns, yet the question of an AI bubble still looms.

On November 19, 2025, Nvidia announced earnings that catapulted it into record territory, yet the message implied that they are just getting started.

With revenue of roughly $57 billion and data-centre sales up 66 percent year-on-year, the chipmaker quieted some of the loudest worries about an impending AI bubble.

But beneath the numbers and bold forecasts, questions linger over whether or not this pace can be sustained. And if not, what happens when the hype meets reality?

What Happened

Nvidia beat Wall Street expectations across the board. The data-centre business, the engine of the AI boom, posted approximately $51.2 billion in quarterly revenue, topping forecasts of around $49 billion.

Earnings per share came in at $1.30, ahead of estimates. The company also projected roughly $65 billion in revenue for the next quarter, above analyst consensus.

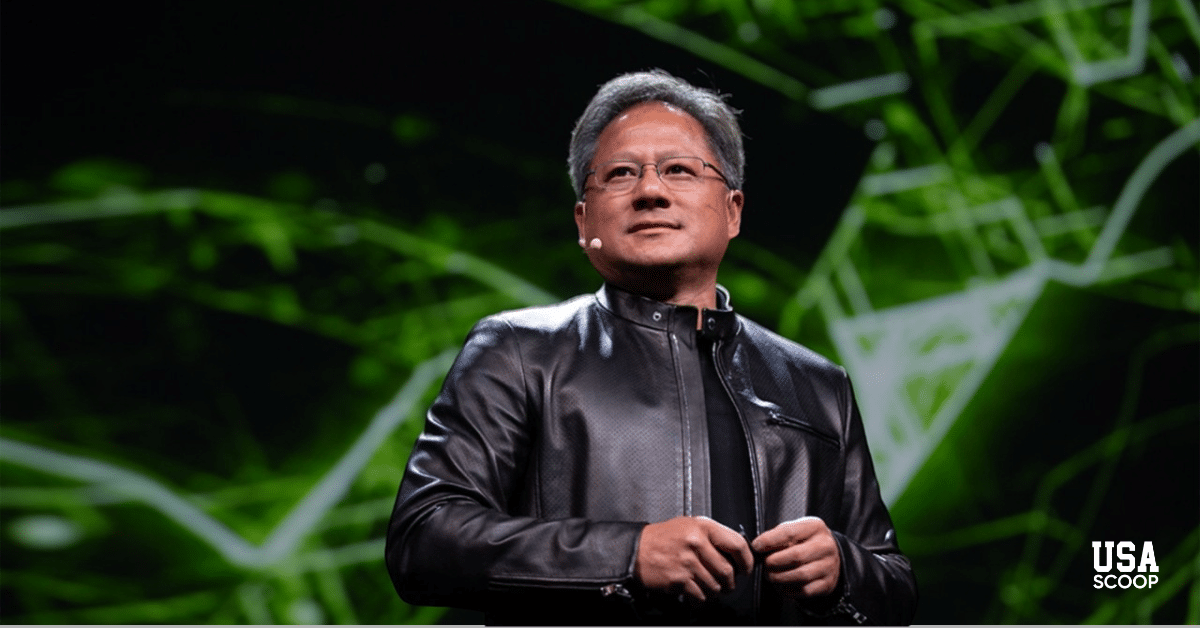

CEO Jensen Huang addressed the so-called AI bubble head-on during the earnings call.

“There’s been a lot of talk about an AI bubble,” he said. “From our vantage point, we see something very different.” His message is that Nvidia isn’t riding a speculative wave, but rather fueling a structural transformation. Despite prior headwinds, major investors selling stakes, and market jitters over valuations, Nvidia posted one of its strongest quarters yet

Why This Matters

Nvidia’s performance matters because it’s seen as the bellwether of the AI hardware industry.

When Nvidia wins, the assumption is the wider landscape is healthy, and when it stumbles, concerns ripple across tech stocks. In this case, the win helped calm short-term anxiety. Tech indexes rallied, and investor sentiment brightened, however cautiously.

The broader significance is whether this surge is sustainable.

The leap in revenue suggests remarkable demand, but it also raises red flags.

Can the world’s data-centre pipeline keep filling?

Will capital costs, energy constraints and supply-chain bottlenecks start to bite?

Nvidia itself flagged these pressures. “Customers with less financial firepower may face difficulties securing financing for large-scale infrastructure projects.”

In short, the company seems to be winning now, but the bigger question is, can the industry keep up?

The Backstory

Since the breakout of generative AI (tools like ChatGPT) in the past two years, Nvidia has ridden a transformation wave.

Its chips underpin the infrastructure of cloud providers, AI model builders and enterprises rushing to adopt AI. Some reports suggest Nvidia already has $500 billion in orders booked through 2026.

Yet critics have been warning about a bubble for months. High valuations, heavy capital expenditures, and electric and computing demands all signalled uncertain ground. Some industry veterans likened the AI frenzy to past tech bubbles.

What Nvidia’s earnings show is that, for now, revenue growth is catching up to the hype. But the underlying structural risks remain. The difference now is that Nvidia is setting the tone, if its engine slows, the entire ecosystem may wobble.

The Reaction

The market reaction was swift: shares rose by about 5 percent after hours. Other tech stocks followed.

But even among bullish voices, there were hedges. For example, Tableau warned that power and land constraints for data-centres may become a gating factor.

While the short-term is strong, the long-term value depends on whether AI hardware becomes commoditised or retains its high margin. In other words, it’s a great quarter now, but the tougher test is what happens when everyone has what they need.

Why You Should Care

If you are invested in tech, this moment matters for your portfolio. Nvidia’s health is a proxy for risk appetite and tech sector trajectory, and if Nvidia slows, it could reverberate far.

Even if you are not a trader, you should care because what happens in AI infrastructure touches everyday technology, i.e. cloud services, generative AI tools, enterprise software, and automation.

If the hardware foundation falters, the ripple effects will reach companies, jobs and innovation timelines.

Final Thought

Nvidia’s Q3 earnings pack a punch, such as strong revenue, bullish guidance, and a clear message that the company believes the AI boom is still in early innings.

The message to the world is that they are building a platform. But the more important challenge that lies ahead is can the platform scale at the levels implied? Because if not, the AI surge may run into the same old barriers, such as cost, competition, and capacity.

For now, Nvidia has won its quarter. The question is whether the winning streak continues, or whether the sector reaches a plateau before it ever truly reaches its peak.