Polymarket Shock: Traders Cash In $630K Before Maduro Raid

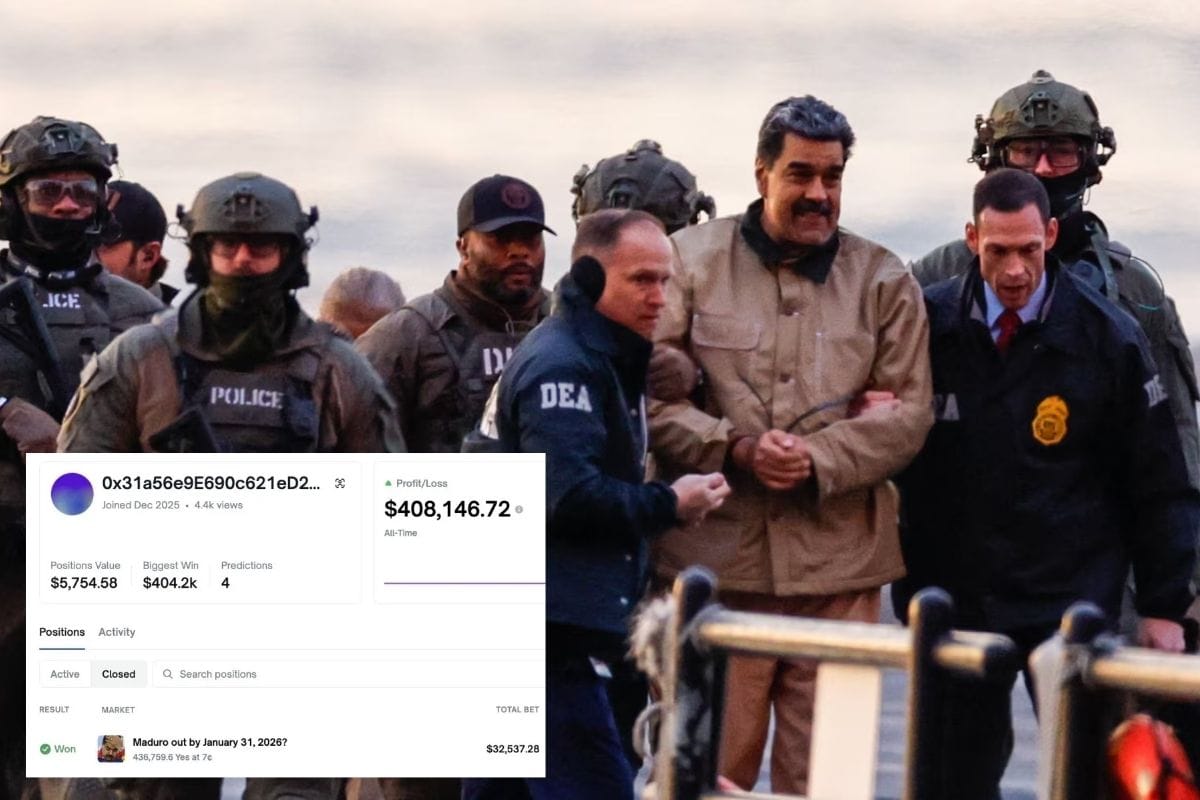

In the fast-moving world of online prediction markets, big wins are not unusual. But every so often, a payout raises eyebrows across the internet, and that’s exactly what happened after Venezuelan leader Nicolás Maduro was captured by U.S. forces in a surprise overnight operation.

Just hours before the raid, three anonymous traders on Polymarket walked away with more than $630,000 by betting that Maduro would be forced out of power before the end of January. The timing of the bets, the size of the payouts, and the sudden shift in odds have all sparked serious questions about whether inside information may have played a role.

A Low-Odds Bet That Paid Off Big

On Friday afternoon, one Polymarket user placed a bold wager that few others believed in. Using a newly created wallet, the trader bet $34,000 on the question: “Will Nicolás Maduro be forced out of power by January 31, 2026?”

At the time, the odds of that outcome were just 6%. In other words, the market was overwhelmingly skeptical that Maduro’s decades-long grip on power would end so suddenly. For most traders, the idea seemed far-fetched.

But within minutes of that wager, something unusual began to happen.

The probability began climbing sharply, doubling to 12.5% within about 35 minutes. That kind of sudden movement typically signals heavy buying, often driven by new information or coordinated trading.

Then came the bombshell.

U.S. Raid Confirms the Shocking Outcome

In the early hours of Saturday morning, President Donald Trump announced that U.S. special forces had captured Maduro and his wife, Cilia Flores, during a covert operation in Caracas. The Venezuelan leader was removed from the country and flown to the United States, where he now faces federal charges.

The Polymarket question was immediately resolved in favour of the “Yes” outcome.

The result? That single $34,000 bet exploded into a return of more than 1,200%, earning the trader hundreds of thousands of dollars almost overnight. Two other anonymous wallets placed similar wagers and also cashed in, bringing the combined winnings to over $630,000.

Suspicion Grows Over Timing and New Wallets

What has fueled suspicion is not just the profit, it’s how the profit was made.

All three wallets involved were reportedly created shortly before the bets were placed. None showed prior trading history. And all three placed wagers within hours of the U.S. operation that ultimately removed Maduro from power.

On social media, users quickly began asking uncomfortable questions.

“How does someone risk $34,000 on a 6% probability event and get it exactly right hours before a military raid?” one commenter asked.

Others suggested that the traders may have had access to classified or leaked information, even if indirectly. While there is no public evidence confirming insider trading, the optics alone have made the story explode online.

Polymarket’s Gray Area

Polymarket, like many prediction markets, operates in a legal gray zone. It allows users to wager on political, economic, and geopolitical outcomes using cryptocurrency. While the platform does prohibit insider trading in theory, enforcing those rules is extremely difficult when traders remain anonymous and operate across borders.

Prediction markets rely on the idea that crowds collectively price information more accurately than traditional forecasting. But when outcomes involve military action or classified government operations, the line between informed speculation and illicit knowledge becomes blurry.

So far, Polymarket has not publicly commented on the trades.

A Broader Pattern of Market Whiplash

The Maduro arrest didn’t just shake prediction markets; it rippled across global finance.

Energy stocks surged, defense stocks jumped, and gold prices spiked as investors scrambled to respond to the sudden geopolitical shift. Yet oil prices remained surprisingly stable, reflecting skepticism about how quickly Venezuela’s production could realistically recover.

For traders watching from the sidelines, the Polymarket windfall became a symbol of how information or the perception of it can move markets faster than governments can explain events.

Could This Have Been Dumb Luck?

There is still the possibility that the traders simply got lucky.

Prediction markets often attract high-risk gamblers willing to place big bets on unlikely outcomes. Every once in a while, someone wins spectacularly. From a purely statistical standpoint, improbable events do happen.

But critics argue that three new wallets, placed within hours, on the same unlikely outcome, just before a classified military action, stretches the definition of coincidence.

Even seasoned crypto traders have admitted that the timing feels “too perfect.”

What Happens Next?

Whether a formal investigation will follow remains unclear. Because Polymarket operates outside traditional financial regulation, tracing intent or insider knowledge would be difficult even for authorities.

For now, the traders remain anonymous, the profits remain real, and the questions remain unanswered.

What is clear is that the episode has reignited debate over whether prediction markets are simply modern forecasting tools or whether they risk becoming vehicles for exploiting privileged information during moments of global crisis.

As one market watcher put it: “When politics turns into a betting slip, someone always knows more than the odds suggest.”

In this case, someone knew a great deal.