Tesla Bets $2B on Musk’s xAI as EV Sales Slip and AI Dreams Take Center Stage

Tesla is making one of its boldest moves yet, and it has little to do with electric cars.

The company announced it will invest $2 billion into xAI, the artificial intelligence startup founded by CEO Elon Musk, even as Tesla faces slowing vehicle sales and its first annual revenue decline in years. The decision signals a clear message to investors and critics alike: Tesla’s future is no longer just about cars it’s about artificial intelligence.

While some see the move as visionary, others see it as risky. What’s clear is that Tesla is doubling down on Musk’s long-standing belief that AI, not electric vehicles, will ultimately define the company’s value.

A Strategic Shift as EV Sales Lose Momentum

Tesla’s core electric vehicle business is under pressure.

In 2025, the company reported a 3% drop in annual revenue, marking its first full-year decline. Competition from cheaper EVs, reduced government incentives, and shifting consumer sentiment have all taken a toll. To keep sales moving, Tesla has leaned heavily on discounts and lower-priced models a strategy that has helped volumes but squeezed margins.

At the same time, Musk’s increasingly political public persona has alienated some customers, particularly in key U.S. and European markets.

Against this backdrop, the $2 billion investment in xAI feels less like a side project and more like a necessary pivot.

Why xAI Matters to Tesla

xAI isn’t just another startup Musk happens to own.

The company is building advanced AI models designed to compete with the biggest players in the space. For Tesla, that technology could become the backbone of everything from Full Self-Driving software to robotaxis and even humanoid robots.

Analysts say Tesla is now asking investors to believe in future AI revenue before those products are fully proven.

“This is a transition phase,” said one market analyst. “Tesla is effectively saying: judge us not by car deliveries, but by how fast our autonomy and AI roadmap progresses.”

The Cybercab and the Robotaxi Vision

One of the biggest bets tied to xAI is Tesla’s Cybercab robotaxi.

Tesla says production plans for the driverless vehicle are still on track for this year. The Cybercab is designed without a steering wheel or pedals and is meant to operate entirely on autonomous software.

If successful, it could unlock a recurring revenue stream far more lucrative than car sales. Musk has long argued that a fleet of robotaxis could transform Tesla into a transportation platform rather than a car manufacturer.

But there’s a catch.

Regulatory hurdles remain significant. Current federal rules limit how many non-traditional vehicles can be produced each year, and while lawmakers are considering changes, timelines remain uncertain. Musk himself recently admitted early production would be “agonizingly slow.”

Investors Cheer, Skeptics Stay Cautious

Despite the risks, Wall Street initially reacted positively. Tesla shares rose nearly 4% after the announcement.

Supporters argue that investing in xAI gives Tesla direct access to cutting-edge AI technology at a time when artificial intelligence is reshaping every major industry. They believe Tesla’s massive driving data gives it a unique advantage in training autonomous systems.

Skeptics, however, point to Musk’s history of missed deadlines and overpromising. Full Self-Driving has been “almost ready” for nearly a decade, and robotaxis have yet to operate at scale anywhere in the world.

For now, faith in Musk remains a powerful force.

A Broader Pivot Toward AI and Robotics

The xAI investment fits into a wider transformation underway at Tesla.

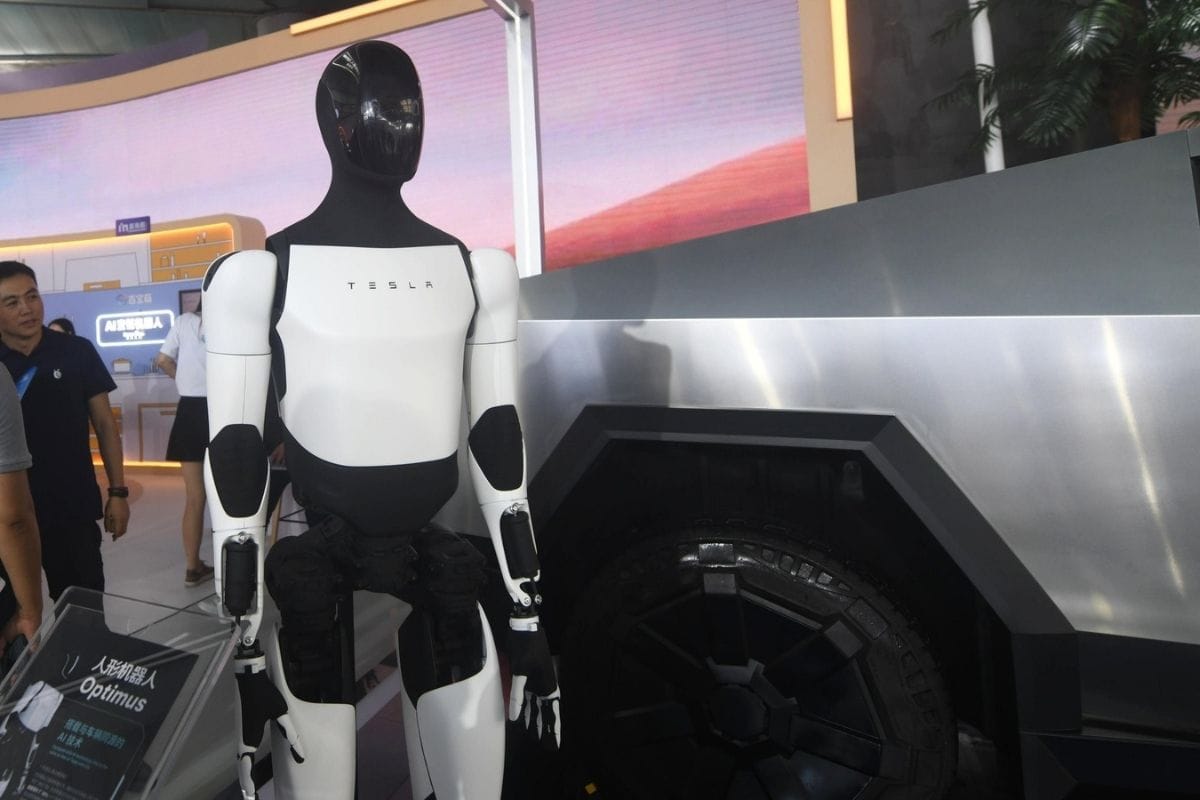

Beyond robotaxis, the company continues to develop Optimus, its humanoid robot, which Musk believes could eventually outperform Tesla’s car business. The vision is ambitious: robots handling factory work, logistics, and even household tasks.

Meanwhile, Tesla’s energy generation and storage business has quietly become a bright spot. Demand for large-scale batteries used to support power grids continues to grow, helping offset weaknesses in the EV segment.

Taken together, these shifts suggest Tesla is evolving into a diversified AI-driven technology company, whether customers and regulators are ready or not.

What’s at Stake for Tesla’s Future

Tesla’s valuation still reflects enormous expectations.

At roughly $1.5 trillion, the company is priced not as a carmaker, but as a future leader in autonomy, robotics, and artificial intelligence. The $2 billion bet on xAI reinforces that narrative and raises the stakes.

If Musk delivers, Tesla could redefine transportation and automation. If not, critics warn the company could find itself stretched thin, juggling too many bold ideas while its core business struggles.

For now, Tesla is betting big that AI will steer it into its next era.

And Elon Musk, once again, is asking the world to follow him into the future even if the road there remains uncertain.