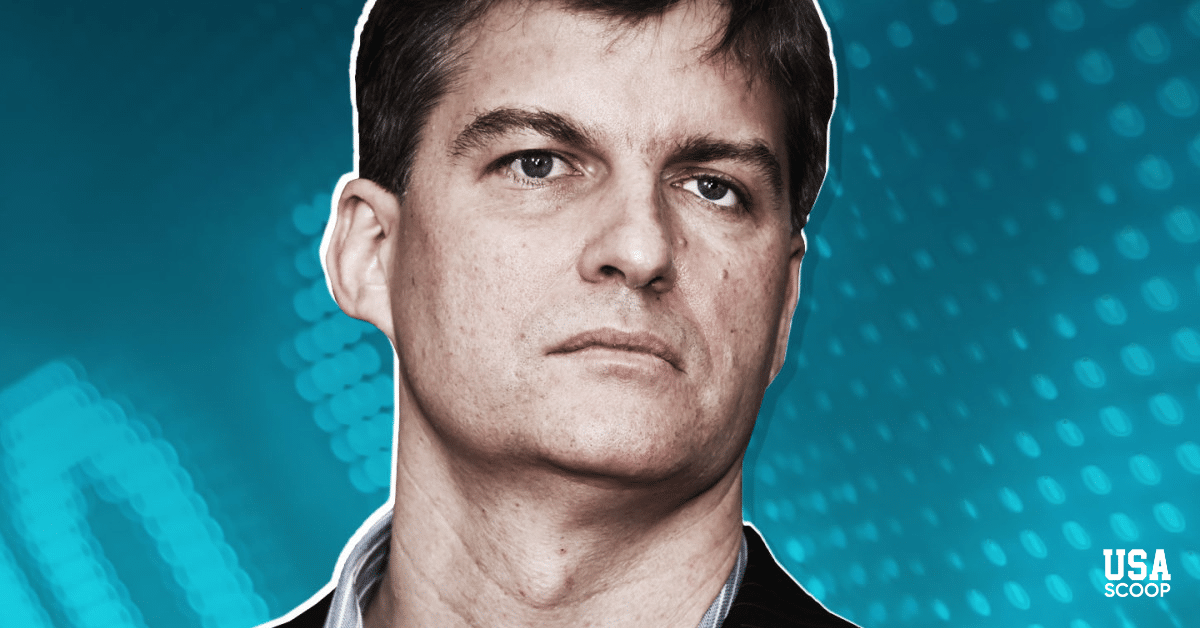

Why Did ‘Big Short’ Michael Burry Exit the Hedge Fund Game?

Michael Burry, the investor who foresaw the 2008 housing crash and inspired The Big Short, has quietly pulled his firm out of the hedge-fund business. His firm, Scion Asset Management, terminated its registration with the U.S. Securities and Exchange Commission (SEC) on November 10 2025, meaning he’s no longer managing money for external investors in the same way.

This move comes amid Burry’s vocal warnings about what he sees as an over-heated market, especially in tech and artificial intelligence stocks. On social media, he hinted that his next act begins on November 25th, and said he’s moving on to much better things. For investors, analysts, and market watchers, the question now isn’t just “Why?” but “What’s next?”

What Happened and Why It Matters

The SEC filing shows Scion’s registration status was changed to terminated as of November 10. That means Burry no longer has to file regular reports on assets or trades for external clients, a hallmark of hedge-fund regulatory disclosure. Scion last reported about $150-155 million in assets under management.

In a letter dated October 27 to his investors (per the Financial Times), Burry wrote, “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.”

And on social media, he added, “On to much better things Nov 25th.”

So yes, the man famous for betting against the biggest bubble of his generation is now stepping off the stage, and that sends a loud signal.

Burry’s Market View And Why He Walked Away

Burry has long been a contrarian. He made his name by shorting subprime mortgages and watching the US housing market collapse. Now, he’s pointing to what he sees as another bubble, this time in tech and AI.

He’s recently criticised firms like Nvidia and Palantir Technologies for stretching accounting rules. He even claimed that hyperscalers will understate depreciation by $176 billion from 2026 to 2028.

With markets riding high, the S&P 500’s long streak, AI hype dominating headlines, and Burry appears to have concluded that his style of investing simply doesn’t fit the current environment.

What This Means for Investors & Markets

For everyday investors and observers, this is more than a celebrity fund manager exiting quietly. It’s a sign that, His exit could also influence other hedge funds. Some may follow, scaling back outside clients or shifting to private family offices.

When someone of Burry’s caliber and reputation stops managing outside capital, the message is loud that he is repositioning . If someone with a history of spotting bubbles steps out, maybe we ought to ask whether current valuations are simply too aggressive.

What Remains the Same, and What’s Changing

Although Scion is deregistered, Burry isn’t gone. His social posts show he intends to remain active, albeit in a different capacity. Whether he will manage his own capital, launch a new vehicle, or simply invest quietly is still unknown.

At the same time, by reducing external obligations, he frees himself from quarterly disclosures and investor demands. That gives him flexibility, but also removes the accountability framework that public funds face.

For stakeholders in tech stocks, AI plays, and broader market valuation conversations, Burry’s departure adds a spotlight. Historically, he hasn’t been wrong about major market excesses.

What Analysts Are Saying

Investment analysts watching Burry’s move point to a broader trend, short sellers and bearish hedge funds are under pressure in a bullish, momentum-driven market. According to the Financial Times, other high-profile investors like Jim Chanos and teams at Hindenburg Research are also retrenching.

What’s Next for Burry?

The big date is November 25th, when Burry teased something new, potentially a new fund, vehicle, or simply a public commentary platform. Whether it’s a quiet family-office style switch, a new thematic hedge fund, or something entirely different remains to be seen.

Investors will watch his next moves closely. If he launches a new vehicle ranked around water, farmland or value-investing, it will reflect his long-term style.

If he goes big on bearish bets again, say bigger than his Palantir/Nvidia puts, that will amplify the signal. And for tech stocks or companies racing to monetize AI hype, if Burry is stepping back because he believes valuations are detached from earnings, that’s your early warning bell.

Takeaway

Michael Burry’s deregistration of Scion Asset Management is an alert. When a historic bubble spotter steps off the field, markets should take notice. Whether he’s prepping a new vehicle or just stepping away from outside money, his move is a signal the market may be far less safe than it looks.